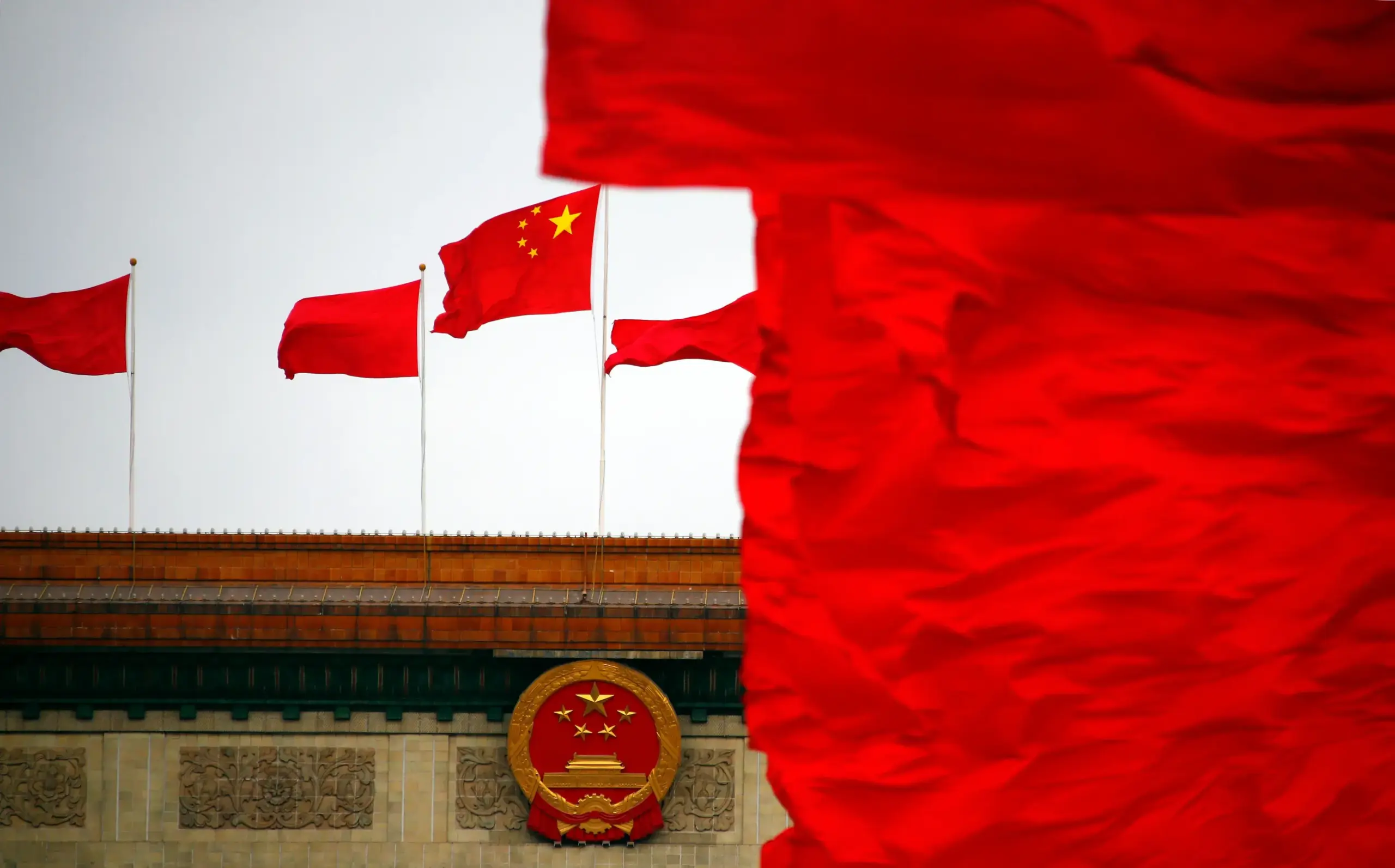

By all outward appearances, China still projects an image of might: gleaming skyscrapers, an army of exporters, and a rising global presence. But beneath that polished surface lies a deeper truth—one that’s becoming increasingly difficult to conceal. According to investor Kyle Bass, we’re not witnessing a slowdown in China’s economic miracle. We’re witnessing its unraveling.

What’s striking is that this isn’t coming from some fringe analyst shouting doom from the sidelines. Bass, a seasoned investor known for predicting past global financial shocks, is pointing to something far more structural than short-term turbulence: a system riddled with unsustainable leverage, crumbling internal demand, and a rigid political regime unwilling to tell the truth about either.

Let’s start with the basics. China’s banking sector is, on paper, a behemoth. It’s more than three times the size of the country’s GDP—an astronomical ratio that dwarfs even the most bloated Western systems. A stunning 40% of those bank assets are tied up in real estate, a sector that’s not just softening but imploding. Property values have dropped by as much as 50% in some regions, hollowing out what was once the central engine of China’s growth. If you’re looking for comparisons, think back to the U.S. housing collapse in 2008—but double the scale and subtract the transparency.

Real estate wasn’t just a sector in China—it was the social contract. It lifted hundreds of millions from poverty and propped up local governments hungry for land-sale revenues. But it also priced an entire generation out of the housing market. The result? Fewer marriages, collapsing birth rates, and a long-term demographic crisis that makes Japan’s aging population look manageable by comparison.

And yet, Beijing remains tight-lipped. Official statistics, curated to the decimal point, are designed to soothe rather than inform. But markets have their own way of revealing what governments won’t. Bond yields in China are telling a sobering story: a 30-year yield below 2% doesn’t scream “growth economy.” It whispers “recession.”

Meanwhile, China’s international dealings—the so-called “China Inc.” model—are no less precarious. For years, China fueled its rise by being the world’s factory floor, hoarding dollars through trade surpluses, and reinvesting them into everything from U.S. Treasuries to a massive military modernization effort. But that model, too, is showing its age. The supply chains are shifting. The appetite for Chinese goods is waning. And perhaps most problematically, trust in Chinese financial products is evaporating.

Consider the absurdity: tens of millions of Americans hold shares in Chinese companies through U.S.-listed vehicles known as Variable Interest Entities (VIEs). But these aren’t real ownership stakes. They’re legal fictions—shell structures in the Cayman Islands that offer no claim to Chinese assets and zero recourse in a dispute. Investors aren’t buying stock in companies. They’re buying stories. And the story, it turns out, may have a very bad ending.

You might wonder how we got here. The short answer is wishful thinking, amplified by Wall Street’s unrelenting hunger for returns. The long answer involves policy failures, regulatory loopholes, and a deep-rooted assumption that market access to China was worth almost any risk. That assumption is now being stress-tested.

None of this is happening in a vacuum. The global economy—still reeling from inflationary aftershocks, war in Europe, and simmering conflict in the Middle East—is entering another phase of volatility. And as Bass warns, we’re approaching a moment where China may move to take Taiwan, shifting the tension from economic to kinetic. If that happens, all bets are off.

So where does that leave the United States?

Bass, ever the pragmatist, sees an opportunity in crisis. He places his bets on a reinvigorated Treasury Department under Scott Bessent, a financier with nothing to prove and no need to court foreign capital. Combined with what Bass sees as a business-savvy, economically aggressive Trump administration—bolstered by voices like Elon Musk and Vivek Ramaswamy—he envisions a strategy of fiscal discipline, deregulation, and a hard-nosed reassertion of U.S. economic dominance.

But let’s not kid ourselves. The U.S. faces its own debt dilemmas. We’ve ballooned the Federal Reserve’s balance sheet from under $1 trillion to $9 trillion in just over a decade. Five of those trillions were printed in a mere 24 months. This isn’t sustainable. Nor is the inflation we’ve exported to fragile economies worldwide—from South America to the Middle East—creating political tinderboxes that could ignite at any moment.

Still, there’s a stubborn, almost defiant optimism in Bass’s outlook. The U.S., for all its flaws, remains the global epicenter of capital, innovation, and rule of law. While the world stumbles through disarray, investors keep turning to American markets, not just because they’re profitable, but because they’re trusted. In a world where economies are buckling under authoritarian mismanagement and bloated speculation, that trust is priceless.

But make no mistake: the window for action is narrow. The U.S. must grow, and fast—not through gimmicks or giveaways, but through unleashing the entrepreneurial forces it once championed. If it doesn’t, it risks being swept into the same tide of decline it now observes from afar.

In the end, the fall of China’s economic model isn’t just a Chinese problem. It’s a mirror, reflecting both the vulnerabilities of a closed system and the dangers of believing in a miracle that never really was.